How to Work with hard money lenders in Atlanta Georgia

How to Work with hard money lenders in Atlanta Georgia

Blog Article

Exactly how to Safeguard a Hard Money Financing: Steps to Simplify the Refine

Navigating the financial landscape can be tough, particularly when it concerns safeguarding a Hard Money Finance. These financings, usually utilized in real estate transactions, require a clear understanding of personal finances, the borrowing market, and open interaction with possible lending institutions. The process might appear complex, yet with the appropriate method, it can be streamlined and reliable. As we discover this topic additionally, you'll uncover necessary actions to simplify this economic journey.

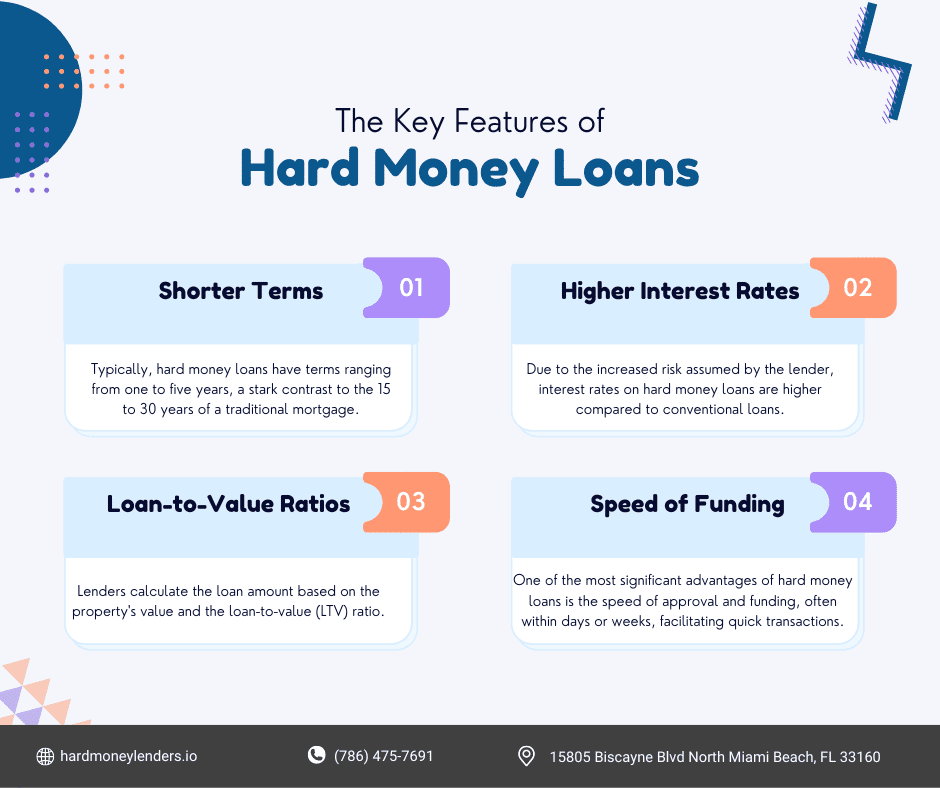

Comprehending What Hard Money Loans Are

Tough Money financings, commonly viewed as the economic life raft in the substantial sea of genuine estate, are an unique kind of financing. Unlike standard bank loans, difficult Money financings are not mainly based on the customer's credit reliability yet instead the worth of the property being bought. Understanding these essential attributes is fundamental in navigating the unstable waters of hard Money financings.

Establishing if a Hard Money Financing Is the Right Choice for You

Is a Hard Money Financing the very best option for you? The answer lies in understanding your economic situation, investment plans, and credit scores condition. This Finance kind appropriates for individuals with less-than-stellar credit report, as tough Money lending institutions primarily think about the value of the property, not the customer's credit reliability. Furthermore, if a quick closing process is critical, a Hard Money Financing can quicken process, bypassing the prolonged approval procedure traditional lendings demand. One must be conscious that difficult Money loans frequently carry higher interest rates. For that reason, they need to assess their ability to birth these costs. It's also essential to examine the risk linked to the security, as failure to pay back could result in loss of the asset. Lastly, an understanding of the Loan terms is important.

Preparing for the Financing Application Refine

Prior to embarking on the procedure of securing a Hard Money Funding, it's vital to sufficiently prepare. Prep work involves gathering essential documentation such as evidence of income, credit rating records, and a thorough strategy of home usage. Applicants need to additionally be prepared to show their ability to make Financing payments. It's advisable to perform an extensive home appraisal, as the value of the home frequently figures out the Lending quantity. A thorough understanding of one's financial scenario is crucial. This includes understanding all debts, properties, and revenue resources. Potential customers need to be prepared for a feasible background check. Failure to precisely prepare can cause delays and even being rejected of the Lending application.

Browsing Interest Prices and Loan Terms

Browsing rates of interest and Funding terms can be a complicated part of safeguarding a Hard Money Lending. Comprehending interest rates, understanding Loan terms, and working out desirable problems are crucial elements to take into consideration. These aspects, when appropriately comprehended, can dramatically affect the total expense and price of the Finance.

Comprehending Rates Of Interest

A considerable majority of tough Money Lending applicants find themselves astonished by the details of interest rates. hard money lenders in atlanta georgia. In the context of tough Money finances, interest rates are usually greater than those of typical loans due to the inherent risk involved. Recognizing these prices help debtors in evaluating if a Hard Money Lending is a sensible option or if various other financing alternatives would be more cost-effective.

Deciphering Finance Terms

Decoding the terms of a Hard Money Finance can often seem like a difficult job. Lending terms, typically including the Finance amount, rate of interest price, Finance duration, and repayment timetable, can substantially affect the borrower's financial commitments. The passion price, typically higher in difficult Money finances, is another vital element to think about.

Negotiating Desirable Problems

Safeguarding positive problems in a Hard Money Finance entails skilful negotiation and an eager understanding of passion rates and Funding terms. A borrower ought to not shy away from discussing terms, questioning conditions, and suggesting adjustments.

Understanding rate of interest is pivotal. One must understand whether the rate is fixed or variable, and how it might fluctuate over the Financing term. It's vital to safeguard a rates of interest that aligns with one's monetary abilities.

In a similar way, Finance terms ought to be completely examined. Facets like repayment routine, prepayment fines, and default effects should be understood and bargained to stay clear of any future surprises.

Reviewing and Selecting a Hard Money Loan Provider

Picking the right tough Money lender is an important action in securing a financing. hard money lenders in atlanta georgia. It calls for comprehending the loan provider's standards, evaluating their degree of transparency, and considering their versatility. These components will certainly be checked out in the complying with areas to direct individuals in making a notified decision

Recognizing Lenders Criteria

Inspecting Lenders Openness

This aspect is crucial as it guarantees that all Funding conditions, prices, and terms are clearly communicated and conveniently recognized. It is advised to request a clear, detailed written proposal detailing all elements of the Loan arrangement. In essence, the customer's capacity to comprehend the Loan arrangement substantially visit this page depends on the loan provider's openness.

Examining Lenders Flexibility

Ever before thought about the importance of a loan provider's flexibility when looking for a Hard Money Loan? A lending institution's ability to adjust to unique scenarios is a substantial element. This attribute can mean the distinction in between a smooth deal and one filled up with challenges. Adaptability may show up in different forms, such as versatile Funding terms, willingness to work out charges, or acceptance of non-traditional security. It's vital to evaluate potential lenders based on this feature. One can do so by researching their history, requesting testimonies, or checking out reviews online. Keep in mind, a lending institution's adaptability can be a lifeline in unforeseen scenarios. As a result, when securing a Hard Money Lending, do not forget the aspect of lender versatility.

What to Expect After Securing Your Tough Money Loan

Once your tough Money Loan is secured, a new phase of the lending procedure starts. The borrower now enters a settlement duration, which may vary depending on the specifics of the Lending agreement. This duration is typically temporary, ranging from year to a few years. It is essential for the borrower to comprehend the regards to the Lending, consisting of the rate of interest and settlement timetable, to stay clear of any kind of unpredicted problems.

In addition, hard Money loans usually feature greater rate of interest than traditional fundings due to their intrinsic risk. Therefore, punctual repayment is suggested to reduce the price. Lastly, it's crucial to keep an open line of communication with the lending institution throughout this phase, making sure any type of concerns are dealt with immediately.

Conclusion

Finally, securing a Hard Money Loan entails comprehending the nature of such loans, analyzing personal financial situations, and discovering a proper loan provider. Attentive preparation, careful navigation of passion prices and Funding terms, in addition to open interaction with the lending institution can about his streamline the procedure. Finally, understanding post-loan duties can make certain effective Financing monitoring. These actions can direct individuals in protecting and efficiently managing a Hard Money Funding.

Navigating rate of interest prices and Loan terms can be an intricate part of securing a Hard Money Loan. In the context of tough Money loans, passion rates are usually higher than those of typical finances due to the fundamental threat included. Lending terms, generally incorporating the Funding quantity, rate of interest price, Loan period, and payment timetable, can considerably influence the customer's financial responsibilities.Safeguarding beneficial problems in a Hard Money Finance involves skilful arrangement and a keen understanding of passion prices and Funding terms.In final thought, safeguarding a Hard Money Loan includes recognizing the nature of such fundings, assessing personal monetary scenarios, and finding a proper lending institution.

Report this page